Start by writing unit tests for your code, which test individual components in isolation. Then, move on to integration tests, which test the interactions between different components and modules. Integration tests help identify any compatibility issues or conflicts between different parts of your code.

Odoo 17 Development Tutorial – Introduction

- These techniques will help you push the boundaries of what you can achieve with Odoo and develop more complex and sophisticated applications.

- Inheritance allows you to add or override specific functionalities without modifying the original module.

- This is the code repository for Odoo 14 Development Cookbook – Fourth Edition, published by Packt.

- Later, he started his own venture named Droggol and now provides various development services related to Odoo.

By mastering the concepts of models, views, and controllers, you’ll be able to effectively develop and customize Odoo applications to meet specific business requirements. Before you can start developing Odoo applications, you’ll need to set up your development environment. This involves installing the necessary 3 ways to annualize a percentage tools and dependencies to run and test your code.

Husen Daudia software developer with a Master’s Degree from Gujarat University, India, is also a SixSigma Black Belt consultant. Husen has played a pivotal role in developing and maintaining various ERP implementationsin both public and private sectors. Outside of work, he is a hobbyist painter and cherishes spendingtime with his sons, Mufaddal and Yusuf. A large variety of features are covered such as fields,views, and even the kitten mode.

Resources

These tests can cover various aspects of your code, such as models, views, controllers, and business logic. By writing tests, you can verify that your code behaves as expected and catches any potential bugs or issues before they reach the production environment. Additionally, Odoo provides a powerful debugging tool that allows you to inspect and analyze the execution of your code. The debugging tool provides features such as breakpoints, step-by-step execution, variable inspection, and stack traces, making it easier to identify and fix issues in your code. To dive deeper into the Odoo framework, it’s important to understand the concept of models, views, and controllers.

Tutorials¶

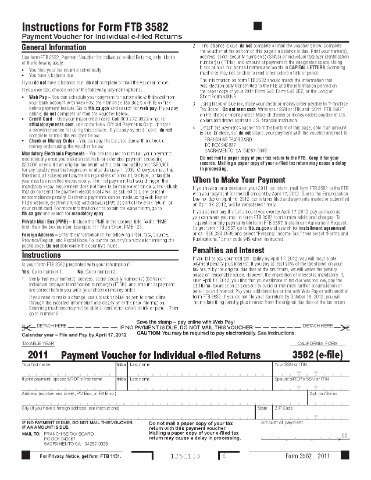

We also provide a PDF file that has color images of the screenshots/diagrams used in this book. This is the code repository for Odoo 14 Development Cookbook – Fourth Edition, published by Packt. Odoo Apps can be used as stand-alone applications, but they also integrate seamlessly so you geta full-featured the accounting entry for depreciation Open Source ERP when you install several Apps.

The community provides forums, mailing lists, and chat channels where you can ask questions, seek advice, and share your knowledge with others. By actively participating in the community, you’ll be able to learn from experienced developers, collaborate on projects, and contribute to the improvement of Odoo. In addition to customizing existing modules, you can also create your own custom modules from scratch. This gives you complete control over the functionality and behavior of your applications.

We can create Sessions from open academy module,This is the Form

These practices ensure that your code is clean, maintainable, and scalable, making it easier to work with in the long run. Widgets determine how the data is displayed and interacted with in the user interface. By creating custom widgets, you can enhance the user experience and provide additional functionalities, such as date pickers, color pickers, or interactive charts. Fields, on the other hand, define the structure and behavior of the data in your applications. By creating custom fields, you can extend the data model and present value pv add new functionalities, such as computed fields, related fields, or fields with custom validation logic. These advanced techniques allow you to create highly tailored and interactive applications that go beyond the standard Odoo functionalities.

When creating custom modules, it’s important to follow the modularization principles mentioned earlier and design your modules in a way that promotes reusability and maintainability. You should also take advantage of the Odoo API, which provides a wide range of tools and functionalities for building Odoo applications. The API allows you to interact with the Odoo framework, access its features and resources, and perform various operations, such as creating records, updating views, and triggering actions. By mastering the art of customizing and extending Odoo modules, you’ll be able to create powerful and flexible applications that cater to the unique needs of your clients.

This allows developers to separate the data, presentation, and business logic of their applications, making it easier to maintain and extend the system. Additionally, the framework comes with a wide range of built-in modules that provide essential functionalities such as CRM, HR, Accounting, and more. By familiarizing yourself with the Odoo framework, you’ll be able to navigate the system with ease and leverage its powerful features to develop robust applications. To become an expert Odoo developer, it’s important to follow best practices when developing Odoo applications.