Contents:

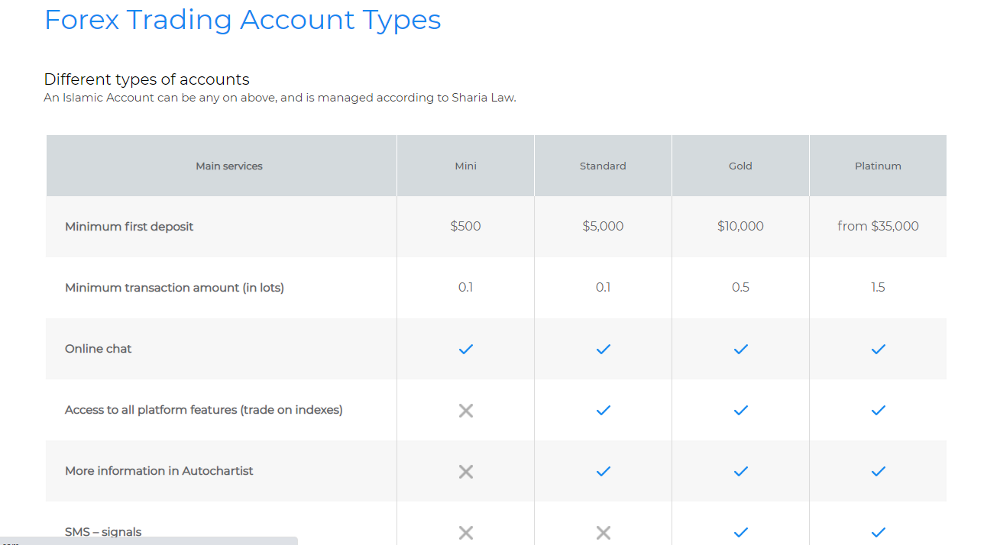

You need to make sure that the profits of your trades are larger than the fees you pay. The next step is to divide the interval upper limit price and interval lower limit price into grid levels. Each exchange has its rules; however, manual and automatic settings are available across all major exchanges, such as Binance, Crypto.com, ByBit, etc. In manual mode, the trader may select levels, and in the automatic mode, grid levels are determined automatically. It provides users with various trading tools for building their own distinct trading bots, unlike presets offered by other platforms.

Bitget Exchange Announced the Launch of the Arbitrum Week – InvestorsObserver

Bitget Exchange Announced the Launch of the Arbitrum Week.

Posted: Tue, 21 Mar 2023 15:03:00 GMT [source]

Once you are connected with an exchange, you can run grid bot strategy. Also, if you are an advanced trader looking to learn some of the tricks used by leading banks, this course is also ideal. As a matter of fact, The Asia Forex Mentor is developed by Ezekiel Chew who has taught some of the leading investment bankers how to trade forex. You will be able to identify a losing trade, gauge price movement under immense trading pressure, and maintain a level head even when the markets are volatile. Use the data from your examination to find the greatest matches and market conditions, then learn how to read the market and develop a feel for what you should focus on when trading. Look at charts with sideways movement and seek out pairs with big swings but still within the same price range.

ATR Grid Trading Strategy

KuCoin was one of the earlier crypto exchanges to launch grid trading. Offering both crypto futures and spot trading, this grid trading service works for many kinds of traders. Since KuCoin lists many altcoins in their ealy stages, this exchange is perfect to take advantage of the early days of new altcoins. Trading fees are another key factor to consider when running a trading bot. Especially when you operate your grid trading bot on the lower timeframes, it will take many trades in rapid succession.

- The upper and lower limit prices define the price range in which the Grid Trading Bot will execute its arbitrage strategy of buying low and selling high.

- It also works with all popular cryptocurrency exchanges, and their free tutorials and guides will help you to master the art of Grid trading.

- To ensure profitability, it is important to be selective with the market conditions appropriate for your strategy.

- Grid trading is one of the proven trading strategies that is also low-risk.

Open Quant, after completing getting-started tasks,we’ll offer you 3 strategies for free, including grid trading. There’s a quantitative trading strategy can “buy low and sell high” automatically in a volatile market. We now have to decide on eight automatic buy and sell limit orders because we chose a grid number of eight. Because the price here will fluctuate between 60,000 USDT and 62,000 USDT, we can adjust our grid accordingly. Use this option if you have sufficient balance in quote and base to re-create the grid at the point where the price exits the grid. Note – this involves cancelling all open orders and close open positions with a market order.

ommas — Best Grid Trading Bot Overall

These orders are automatically executed by the trading botat certain price intervals. Inside the grid, they have at least one buy order and one sell order, but they can set as many additional orders as they want. When manually managing your investments, it’s easy to make impulsive decisions that can lead to big losses. With a grid trading strategy, you can pre-determine your risk tolerance and set up your bot accordingly. This will help you avoid making trades that are too risky and protect your capital.

Bybit revamps grid trading with more bots and features – FinanceFeeds

Bybit revamps grid trading with more bots and features.

Posted: Mon, 19 Sep 2022 07:00:00 GMT [source]

BTC and ETH are two evergreen coins for grid bot trading, as long as you consult the chart. In our CoinSutra VIP program, we often discuss profitable coins for automated trading. BitUniverse is a free trading bot that offers various kinds of grid bots.

How To Find The Best Coins & Pairs For Grid Trading

Grid trading strategy is a popular strategy among day traders and scalpers, as it can be used to capture small profits multiple times throughout the day. Moreover, several elements are considered to improve the profits of grid trading. The good news is that there is a method to profit from the volatility. The majority of traders would love to be able to automate their trades, allowing them to unwind and enjoy consistent profits. AI 2.0 Strategy employs an analysis of market data from the past 7 days, 30 days, or 180 days to inform its recommendations for Grid Trading parameters. This includes the grid interval parameters and the maximum drawdown ratio.

The larger the gap between the lower and upper limits, the higher the profit potential. For example, if a buy order is set at $60,000, the trader will profit more by setting a sell order at $65,000 than at $61,000. It definitely lacks the feature of stop-loss, or auto grid resizing, which may make a lot of difference for many novices.

Equity market benchmark indices trade firm in early trade on continuous buying support from FPIs – The Tribune India

Equity market benchmark indices trade firm in early trade on continuous buying support from FPIs.

Posted: Wed, 12 Apr 2023 10:48:00 GMT [source]

Gate.io also have a native token called GT, which you can use to lower down the trading fees. Now, I feel confident enough to share insights from my learnings, and exploration of these grid trading bots. Grid trading is an automated process where investors set upper and lower limits. When the price hits these limits, the order to buy or sell is automatically executed.

What is Grid Trading

On the other hand, you can only trade within Gate.io, which has quite a limited number of crypto pairs. Manual Mode is designed to set the grid parameters, including upper/ lower limit, grid number, and invested digital assets, manually. Grid bots are quite useful on a sideways market when you’re not sure where the market goes. Moreover, the grid bot’s operational logic allows 100% automatization.

We offer a 7-day free trial so you can access all premium features of the GRID bot in live trading mode as well as in the risk-free virtual Demo mode. Moreover, we provide the Backtesting function which is available in the bot launcher so you can run the bot in a quick simulation. In this example, we will manually customize and set grid parameters. The next step is to choose the contract on which you want the trading bot to be deployed.

The grid trading bot is particularly handy for high-volatility assets in bullish markets. OKX offers many cutting-edge features to help traders quickly deploy sophisticated trading strategies. Among them is our crypto trading bot — a powerful, straightforward-to-use automated trading tool with seven different strategy modes.

Besides that, investors must be in step with the latest news and trends about the market in which they are trading. Breaking news can majorly influence certain markets, such as the Forex and cryptocurrency markets, resulting in quick price drops. It may be shorted when the price rises and sell orders are activated to reduce the long position. The trader makes money when the price fluctuates horizontally, allowing them to activate the sell order. The system will calculate the minimum investment required for the Grid Trading strategy based on the specified price range and the number of grids. The current availability of your funds is displayed below for reference.

What is an infinity grid bot?

Instead, they place a grid of buy or sell orders using the averaging principle. The strategy works well on sideways markets with lots of corrections happening. A grid trading strategy is a technique used by traders to enter and exit positions in a market by placing a grid of pending orders with predetermined price levels. Rather than trying to predict the market’s next move, the strategy aims to generate profit by capturing small price fluctuations over time, regardless of the market’s overall direction. Grid trading bots are trading algorithms or codes that attempt to make profits from price changes within the predefined grid area. The trader sets up the parameters or limits for the grid trading bot to function within the predefined range and execute orders as per forethought rules.

Get to know us, check out our reviews and trade with Australia’s most loved broker. Bitsgap GRID bot allows making a profit in the base or the quote currency. Bracketed buy order refers to a buy order that has a sell limit order and a sell stop order attached. Determine whether the grid will be with-the-trend or against-the-trend.

Grid trading is a trading strategy that takes advantage of crypto price movement by placing strategic limit buy and sell orders. Grid traders set lower and upper limits in a grid where they execute buy and sell orders. If the price drops below the lower limit, a buy order is executed. If the price rises above the upper limit, a sell order is executed. OKX’s crypto trading bot also allows you to manually determine the spot grid parameters.

It is recommended to use stop losses when trading with grids, as a range breakout can result in sharp moves in price. Today, we discuss grid trading bots and how you can use them to your advantage. In the above example of a downtrending market, short-sell orders are set below the reference price. Each short-sell order has a corresponding order to close the short-sell position set at levels below the short-sell orders.

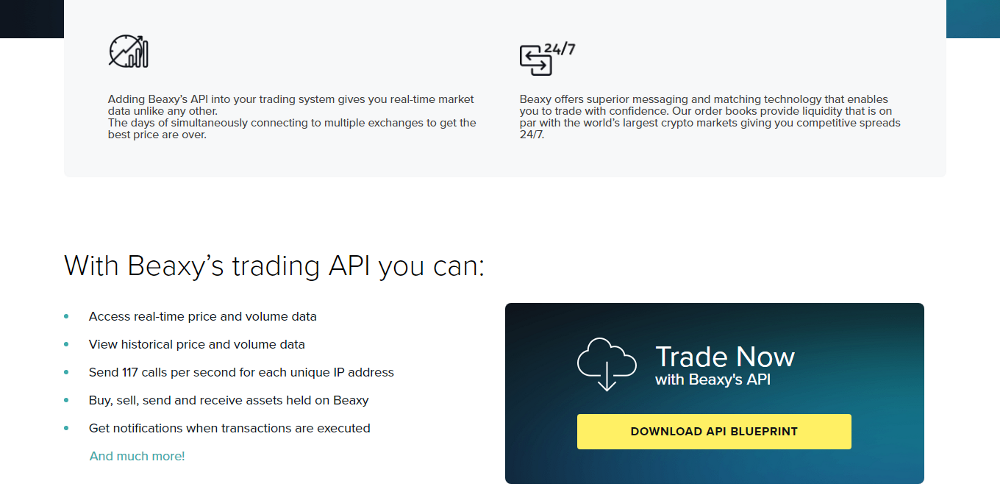

Grid trading bots can automatically execute trades based on predetermined rules, which can save time and reduce emotional decision-making. Traders can also scale their trades by creating multiple grid trading bots for different coin pairs simultaneously. Generally, the trading bot places buy/sell orders between a predetermined price range, constructing an automated trading grid. Grid trading is a quantitative trading strategy that involves placing automated buy and sell orders in an attempt to profit from the volatility of cryptocurrencies. Grid trading is a style of algorithmic trading that automates order execution by utilizing grid trading bots. For those new to grid trading bots, it is recommended to utilize the Pionex AI strategy for setting up the parameters.

Securities and Exchange Commission and a member of Financial Industry Regulatory Authority /Securities Investor Protection Corporation . When everything is all set, the strategy is ready to be executed through your brokerage account. This trade could open four buy orders and four sell orders for this grid, as we set the grid number to eight. However, the price might not dip below our buy orders, and we could end up with only two open orders on the trade. Overall, Bitsgap is something that caught my attention recently, and it may become your choice of crypto grid bot app. Here is where the idea of the Asia Forex Mentor by Ezekiel Chew comes in.

The value of https://forex-world.net/s may fluctuate and as a result, clients may lose the value of their investment. Past performance should not be viewed as an indicator of future results. In Singapore, investment products and services available through the moomoo app are offered through Moomoo Financial Singapore Pte. Ltd. is a Capital Markets Services Licence (License No. CMS101000) holder with the Exempt Financial Adviser Status. This advertisement has not been reviewed by the Monetary Authority of Singapore. In the U.S., investment products and services available through the moomoo app are offered by Moomoo Financial Inc., a broker-dealer registered with the U.S.

If the price moves down to $60,000 again, it fills a buy trade and nets Maxwell just under $8.20 in profit — while also returning the BTC position to roughly its starting size. Huobi Global has developed a system that is well-suited for the newest traders on the block. Their grid-trading service comes with automatic parameter recommendations based on the analysis of historical data.

It was really hard for me to pick the best grid bot tool for the position #3. After careful consideration and testing all the tool, pick Altrady. Altrady is a trading tool that connects with 30+ crypto exchanges via API.

If you ever wondered how to capitalize on Grid trading bots and whether you should try it out, 2022 might be a good year as most markets, including crypto, are sideways. Grid trading bots can be quite helpful If you’re looking for a way to automate your trading and make profits along the way. All types of investments are risky and investors may suffer losses. Past performance of investment products does not guarantee future results. The responsiveness of the trading system may vary due to market conditions, system performance, and other factors. Account access and trade execution may be affected by factors such as market volatility.