Contents

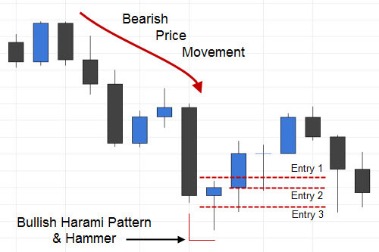

In the above chart, we have a bullish cup and handle formation. The confirmation of this pattern happens when the price action breaks the channel of the handle in a bearish direction. The above graphic shows both the cup and the handle part of the cup and handle chart pattern. If the bullish cup and handle occurs after a bearish price move, it will be considered a reversal pattern. The cup and handle pattern is a bullish reversal chart pattern. After the high forms on the right side of the cup, there is a pullback that forms the handle.

If a cup and handle forms and it is confirmed, the price should see a sharp increase in the short- to medium-term. Making investments based on chart patterns is a norm nowadays as they help traders better understand technical analysis. The cup and handle indicator has long been used by traders to determine the direction in which an asset/stock may move. Additionally, it clearly defines the entry point, stop-loss, and target placement guidelines. However, it is advised to use this pattern along with other tools to make the most out of the opportunities available on the market. The cup and handle pattern is a bullish continuation pattern triggered by consolidation after a strong upward trend.

- While a shallower cup can represent a bullish signal, a deeper cup can produce a bearish signal.

- When the price breaks out of the handle, the pattern is considered complete, and the price is expected to rise.

- This means Institutions are supporting it, a positive sign.

Traders need to look beyond the telltale appearance of a cup and handle on the stock chart and quantify the bullish and bearish sentiments that drive this pattern’s formation. The cup is formed as the price consolidates in a small range following a sharp decline. This consolidation forms the “handle,” which is typically a shorter-term downtrend. Investors typically trade an inverse cup and handle by selling when the price breaks below the handle. The cup should be more U-shaped than V-shaped, as a gentle pullback from the high is more indicative of consolidation than a sharp reversal.

The security bounces and tests the high, drawing in aggressive short-sellers who believe that a new downtrend will elicit a double top breakdown. The cup and handle pattern is a bullish continuation pattern. That means it’ll ultimately culminate in an upward-trending breakout. It’s important for traders to understand the psychology and market action that contributes to its formation, and there are several phases to consider. An inverted cup and handle pattern consists of several candlesticks that form an upside down u formation.

Trading Psychology

On the chart above, I’ve drawn three arcs to represent cups. And it’s a good example of a cup and handle pattern failure. The bounce out of the handle was very small before continuing downward. Consider a scenario where a stock has recently reached a high after significant momentum but has since corrected, falling almost 50%.

You could also use the larger height for an aggressive target. StocksToTrade in no way warrants the solvency, financial condition, or investment advisability ofany of the securities mentioned in communications or websites. In addition,StocksToTrade accepts no liability whatsoever for any direct or consequential loss arising from any useof this information. This is for informational purposes only as StocksToTrade is not registered as a securities broker-dealeror an investment adviser. I often tell new traders to study charts until their eyes bleed.

It begins with a price move in the bearish direction, which reverses gradually. In some cases, the start of the price decrease and the end of the price increase may diverge in terms of the level that they are supposed to be located at. In most cases, the handle is locked within a small bearish channel on the chart.

Protect Your Trade With a Stop-Loss

It will work ok, list of https://forex-world.net/s will be just a bit bigger. If the list is really big, I will increase the criteria to reduce the number of stocks on the list. In the market where false signals are readily available, you can essentially use the Ichimoku Cloud to ignore signals, which lack conviction. The Ichimoku is a pretty complex indicator and defining the indicator is not in scope for this article. To read more on the background of the Ichimoku indicator, please check out this article from Ichimoku Strategy.

This gives you an opportunity as a trader to go short. This breakout was followed by a significant decrease in the price of the currency pair. This will give you an opportunity as a trader to go short. As we have stated above, the best time to enter or open a trade is when the pattern has been confirmed. The first target should be equal to the size of the handle, while the second target should be equal to the size of the cup. You can then create a bearish handle on the right side of the cup.

Next, we need to figure out an entry technique, which brings us to the next step of the Cup and Handle trading strategy. Now we move to the second component of the Cup and Handle pattern and the second step of the Cup and Handle trading strategy. As the rounding bottom comes to a close you will see the strong wall form and the cup advance.

Everyone https://forexarticles.net/s their own way, but be careful about basing ideas or strategies on one only one stock/move. To learn more about scanning, finding explosive trades, and how to trade them, check out my Complete Method Stock Swing Trading Course. Know the proper amount of stock to buy—for the risk of the trade, your risk tolerance, and relative to your account capital—before placing a trade. For example, if the S&P 500 is up 5% over the last 6 months, adjust the 6-month performance to 15% and up (slide the left slider button up to 15%).

The false breakout in the handle on August 13 occurs on low trading volume, demonstrating the importance of using trading volume as a method of confirming the breakout. Estimating the extent of the continuation movement by measuring the distance between the base of the cup and the breakout slightly underestimated the movement. The pattern forms during as a result of consolidation a bullish movement and indicates a continuation of that bullish trend after its completion.

Financial Theories

At the base of the u formation, a new rising wedge or rising channel forms, thus creating the handle formation. A breakout happens when the stock’s price moves above the resistance level formed by the top of the cup portion of the pattern. To protect against losses, many investors set a stop-loss order at a level below the cup and handle pattern. The security finally broke out in July 2014, with the uptrend matching the length of the cup in a perfect measured move. The rally peak established a new high that yielded a pullback retracing 50% of the prior rally, nearly identical to the prior pattern.

If the cup is followed by long-term stability in the asset’s price, then this is considered a revaluation or momentary dip rather than a trading pattern. The cup-and-handle is defined by the short-term dip in an otherwise long-term pattern of growth. A cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart. Learn how it works with an example, how to identify a target. While easy to identify and trade, there are some key drawbacks to cup and handle patterns.

A https://bigbostrade.com/ bottom has a ‘W’ shape and is a signal for a bullish price movement, as price has hit a support level twice and failed to sell off further. The bulls have the upper hand here, and as they buy, prices will rise. The Cup and Handle pattern is often considered a bullish signal. However, there is also the reverse cup and handle, which represents a bearish trade. The handle is formed by a bearish price action that occurs after the formation of the cup. If you are trading a bearish cup and handle formation, you should place a stop loss order just above the upper level of the handle.

This is why it has been given the name ‘Cup and Handle Pattern’. If the stock zooms up and breaks out 30% to 40% from below its old high, it is considered an “overextended” stock, gone up to much to fast. Look for gap-ups & days when the stock jumps on heavy volume. These big up days on heavy volume should not give way to reversals down on heavier volume. Ideally your stock will digest it’s big moves with flat or slightly down days on lighter volume.

The handle is the consolidation before breakout and can retrace up to 1/3 of the cup’s advance, but usually not more. The ideal profit target for the Cup and Handle trading strategy would be equal to the same distance in price as measured from the initial Cup peak to the bottom of the Cup. This gradual and slow range is what will set the stage for the bullish trend to resume. People will think this is a double top which will trap some weak sellers when we finally break upwards. The price drop in a proper handle should be within 12% of its peak.

Remember in this line of work, you just need to be a little bit better than the next trader to make a living. The cup and handle is one of the easiest chart patterns to identify, because we all can recognize a cup. Some of us may not be rocket scientists; however, everyone I know has used a cup in their lifetime. The cup and handle pattern, also sometimes known as the cup with handle pattern was first identified by stockbroker William O’Neil in 1988.

Testimonials on this website may not be representative of the experience of other customers. No testimonial should be considered as a guarantee of future performance or success. If you do not agree with any term of provision of our Terms and Conditions you should not use our Site, Services, Content or Information. Next, look for price to break down out of handle area. Generally, I do not trade every ‘Cup and Handle Pattern’ that I see on the chart.